Description: Billing Management Report

Status: Effective immediately

Date: 29 February 2024

Dynamic interface: Two, Core, Front Desk

Version: 2.0.1.503

Explanation:

It was necessary to tweak the Billing Management Report slightly to work faster on bigger data sets. In addition a net available column was added.

PS 2.0.1.503 is the only version ever released on a Leap Year 🙂

Description: File Cover

Status: Effective immediately

Date: 15 February 2024

Dynamic interface: Two, Core, Front Desk and RMS

Version: 2.0.1.500

Explanation:

Looking for a file and cannot remember the cover color?

Dynamic now allows you to set the file color. A tiny widget with far reaching application. Easily spot and out of place file. This is a user convenience designed to increase visual stimuli for the user.

Description: Client Profile

Status: Effective immediately

Date: 15 February 2024

Dynamic interface: Two, Core

Version: 2.0.1.500

Explanation:

Client Profiles allow easy management of large volume instructions. Any matters for a client with multiple instruction can now be quickly and easily be found, updated and reported on.

Description: Search for Invoice numbers and match to File Number

Status: Effective immediately

Date: 15 February 2024

Dynamic interface: Two, Core

Version: 2.0.1.500

Explanation:

It’s a common time waster to spend time matching Invoice numbers to file numbers. This can happen directly on the bank statement or when splitting bulk payments. Dynamic now has semi-automated search and allocation capabilities which will save your hours of frustration. Simply identify the transactions where invoice numbers appear, select and click the allocate button. Dynamic will search for the invoice numbers found and allocate the correct ledger account number.

Description: Billing Management and Group Billing

Status: Effective immediately

Date: 15 February 2024

Dynamic interface: Two, Core, Front Desk

Version: 2.0.1.500

Explanation:

Group Billing has had a facelift. In addition to the existing functionality, Group Billing will now generate lists of Milestones and Invoice Remittance, making it easier to account to large corporate clients. Especially in the field of insurance and sectional title management, these reports can save a great deal of time.

Remember, Billing Management is your friend!

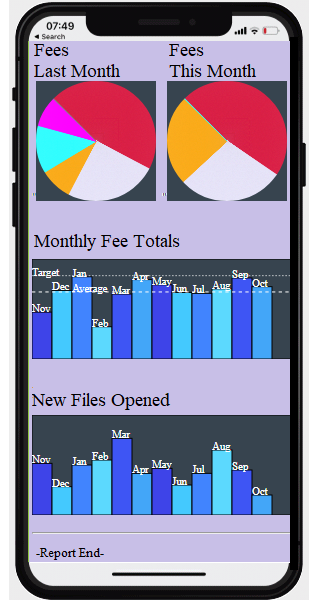

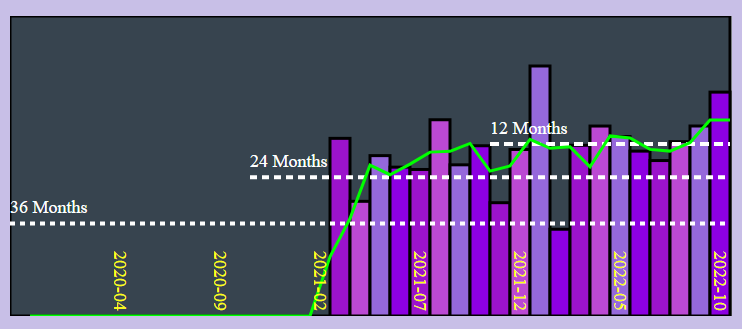

Description: Fees to Target

Status: Effective immediately

Date: 15 February 2024

Dynamic interface: Two, Front Desk

Version: 2.0.1.500

Explanation:

Will we make target? Is a common and recurring question every month. This easy little Fee Report combines current actual Ledger and Fee Book items to give an accurate picture of our current position.

Description: Quality of Life User Experience Improvements

Status: Effective immediately

Date: 15 February 2024

Dynamic interface: Two, Core and Front Desk

Version: 2.0.1.500

Explanation:

Several minor improvements have been made, the most important include:

These include Control+S hotkey on the Fee Book to save fees, and an Alt+L hotkey on certain financial reports in the Core module. The Alt+L key will open the Ledger History Report+ for easy ledger inspection.

Milestone capturing has been streamlined, allowing smooth transaction capturing.

Microsoft Outlook for Windows Calendar appointments can now be scheduled directly from the Notify scheduler. These appointments are all staggered at the top of the day and will result in an Outlook pop-up when starting Outlook in the morning.

Simply Dynamic

Ever wondered how to customize your Dynamic Profile Pic?

Ever wondered how to customize your Dynamic Profile Pic?

You must be logged in to post a comment.